Tokenized Access and Subscriptions

The focus of this piece is to highlight the important business opportunities that social tokens and NFTs enable for services, software, and creators without 3rd party investment. We cover what tokenized access and subscriptions look like, ongoing experiments with the tech, as well as the numerous advantages over traditional SaaS.

By Nir Kabessa and Joey DeBruin - Jun 17, 2021

The focus of this piece is to highlight the important business opportunities that social tokens and NFTs enable for services, software, and creators without 3rd party investment. We cover what tokenized access and subscriptions look like, ongoing experiments with the tech, as well as the numerous advantages over traditional SaaS. We purposefully don't dive specifically into other important benefits that token economies can provide services willing to decentralize, such as governance, DAOs, etc. We mainly focus on the argument that all or most SaaS and creator businesses can and should tokenize subscriptions to their services.

Tokenized services are especially powerful for creators, allowing them to focus on providing a good service, finding customers who want the service (a market fit), and focusing on bringing that customer value. This is good for customers since they can pay less and have a better experience. It's good for creators since they can sustain their businesses.

TradSaaS

If you watch movies, listen to music, or own a phone, you're probably familiar with subscriptions. At least, your wallet is. Instead of selling you today, tomorrow, and next week, they only need to convince you once and the money keeps coming. It's a steady and predictable stream of revenue. Because each customer is so valuable, they can focus more on keeping them than doing anything and everything to get more.

The current standard Software as a service subscription model consists of monthly/yearly recurring payments. It started in publishing, and now it is used in almost all industries, from businesses like New York Times, Netflix, Amazon Prime, Seamless, and Peloton.

Where does it end? Let's divide subscriptions into two categories. The first one is services, like Netflix, Prime, Lootcrate, and Spotify, which kinda have to be subscriptions. Sure, you can buy music and movies individually but here, you get everything. Subscription boxes, which send you new things in the mail every month, are services because they're more about fun and surprise than the stuff itself. And then there are products - things that could be sold, but here are rented.

Access trumps ownership. That's the mantra behind the "subscription economy". - The Economist

What the Economist is referring to as ownership is the mere ownership of one copy of a product or service, as was common in Web1 SaaS (Buy Microsoft Office '09 for a one-time payment of $100). Your business needs either capital or recurring revenue to exist. Subscriptions are the best recurring revenue model. Current SaaS subscriptions are broken. Tokens make subscriptions better for creators and customers

Enter Community Tokens and DAOs

By using tokens as a means of purchasing access to a service, consumers can participate in the potential upside of the demand of that service. They will hold a premium on what they're receiving because they get to earn from the other side of the success. If users have any inclination or any belief that other users will want to use this product, there will be an increase in demand for this product and therefore increasing demand for the token. They will put a premium on it.

Takeaway: Use tokens to create a better subscription model for your business.

Tokenized Access

Tokenized access is the system of gating/limiting content, features, or whole platforms with tokens, requiring users to own/hold specific tokens or NFTs. Teams/creators then monetize by releasing/minting new tokens (inflation) to sell to new customers/speculators. In its full form, it'll feel like subscribing or going through a paywall. This can be used to gate anything and can be coupled with free and traditional subscription options.

If you held $10,000 in bitcoin for the last month, you paid $15/m to secure it.

You didn't pay in subscription fees but rather in agreed-upon inflation. The circulating supply of BTC grew by 0.15% and your holdings' purchasing power was diluted as a result. This newly minted bitcoin was given to miners as block rewards and helped secure their holdings. Block rewards are a form of revenue for miners, and they're critical to maintaining bitcoin.

Inflation-Based Revenue is not new but has been used by governments for generations now. For example, to increase revenue, the US government can, among other things, increase taxes (yearly 'subscription') or print money (inflation).

What if we applied that same line of thinking to SaaS products: B2B, tools, newsletters, passion economy, etc.? Could token subscriptions be valuable to work on in their world?

In line with the transition from passion economy to ownership economy, as beautifully broken down by Jesse Walden, crypto emissions can be thought of as a consistent and stable revenue model for businesses and teams. Token minting is SaaS backward and powerful for users if structured correctly. This could be thought of as the natural next step for consumer software monetization. For example, Microsoft could hypothetically utilize it as their next business model for Microsoft Office:

(1995-2010) Buy Microsoft Office '09 for $100

(2010-2020) Rent Microsoft Office Suite for $9.99 / month

(2020-????) Own access to Microsoft Office Suite for holding 200 OFFICE tokens.

Experiments

Social tokens have pioneered programmable access, with tools like Collab.Land and Mintgate enabling token-gated chat groups, newsletters, and articles. In Bryan Flynn's The fractionalization of NFTs will lead to better social tokens, Tokenized programmable access became popular in the summer of 2020 with a discord bot called Collab.Land which let any token community (ERC721 or ERC20) create their token-gated discords.

Some examples of what tokenized access has gated:

1. Chat groups

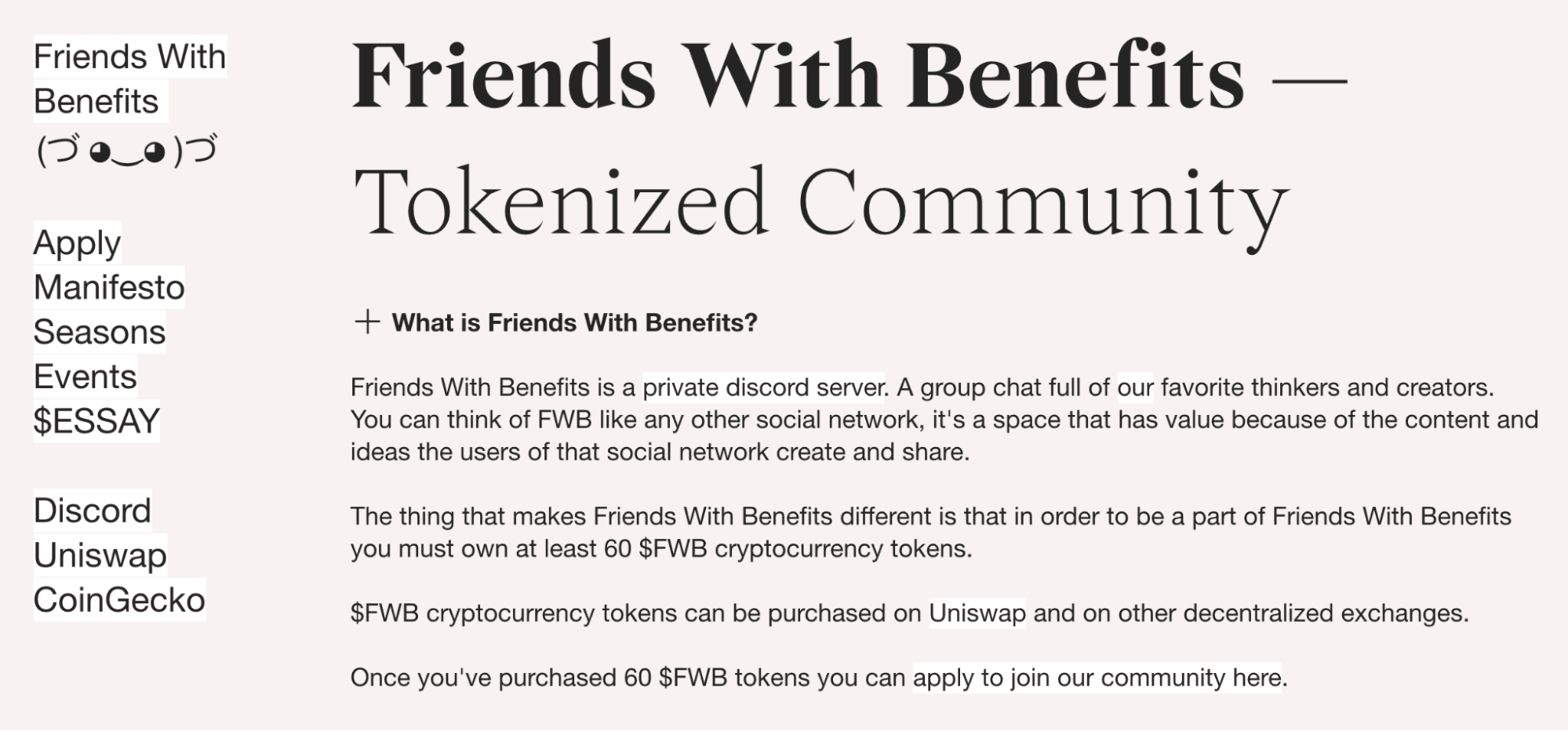

The first use case for tokenized access was token-gated chat groups, with FWB being the famous example. If you hold 55 Friends with Benefits (FWB) tokens, you can access the private discord that has some of the top creative talents in crypto. This has become quite popular among social tokens and has served as a strong mechanism for filtering for quality. For FWB specifically, participants need to apply and be approved in addition to holding tokens.

2. Exclusive content

Apps like Outpost allowed various communities to create token-gated newsletters. This can also be achieved with a mix of Mirror/Medium drafts that are token-gated with MintGate. When perfected, this model can be used to replace/disrupt software like Substack or Patreon. Brian Flynn, writer/leader of Jamm Session, talks about his move to token-gated content in his piece A Letter to Jamm Session Subscribers.

3. Premium Products / Features

Some SaaS products have begun implementing token-gated access. In other words, users need to hold X amount of tokens to geet access to premium features. A great example of this is Astro Tools, which is displayed in the initial image of this article, gating certain features to their DeFi platform with their own ASTRO tokens. Holding 1,000 ASTRO gives you access to their unique block explorer with special filters. Holding 20,000 ASTRO gives you additional wallet tracking features.

4. Shared documents/canvas

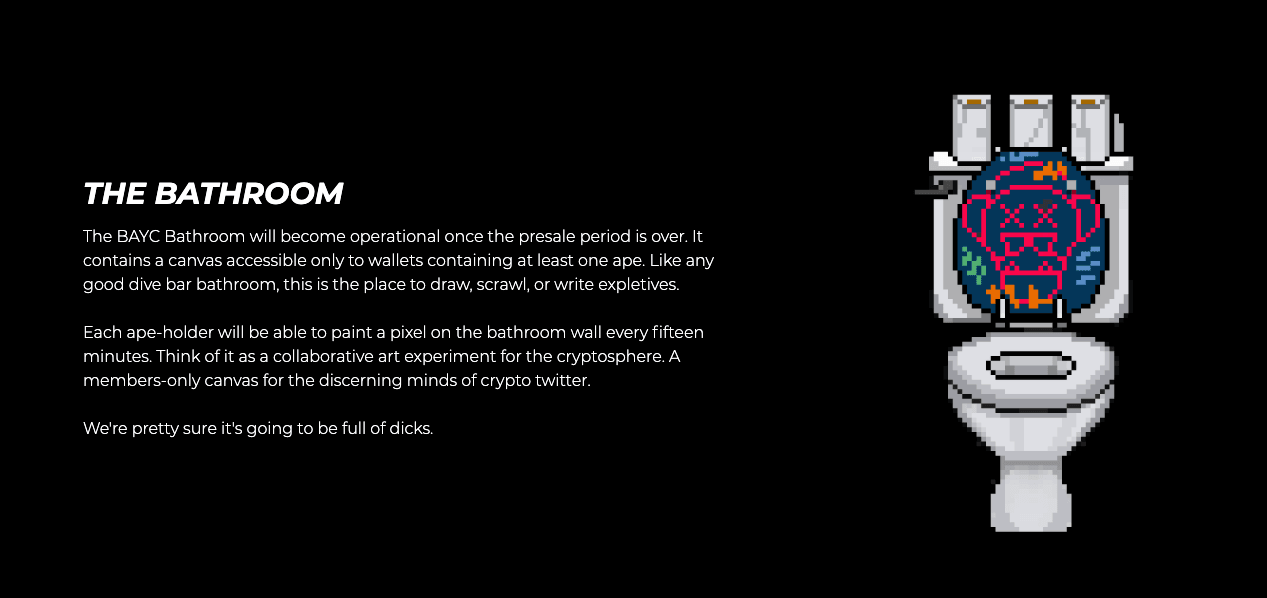

The Bored Apes Yacht Club NFT collection has gone viral over the last few weeks, with floor prices reaching ~4 ETH this week. On their website, they have a BAYC Bathroom, which is an open canvas, like a bar bathroom, where Ape holders can draw / paint. This is reminiscent of pixel walls but limited to Bored Apes only.

5. Beta products

Token holders are usually a good representation of power users and loyal community members. This is why several projects have tokenized access to beta products to their token holdeers. We've witnessed Yearn do this with some of their beta apps, and Zora experimented with this with their TestFlight app and a token to go with it. Similarly, only WRITE token holders can use Mirror.

6. Exclusive Events

As more communities and networks begin to leverage token-gated access, we've begun to witness physical events exclusively limited to token holders. A recent example of this was the FWB Miami party where only holders of 60 FWB tokens could get access to the RSVP link.

7. Unique NFTs

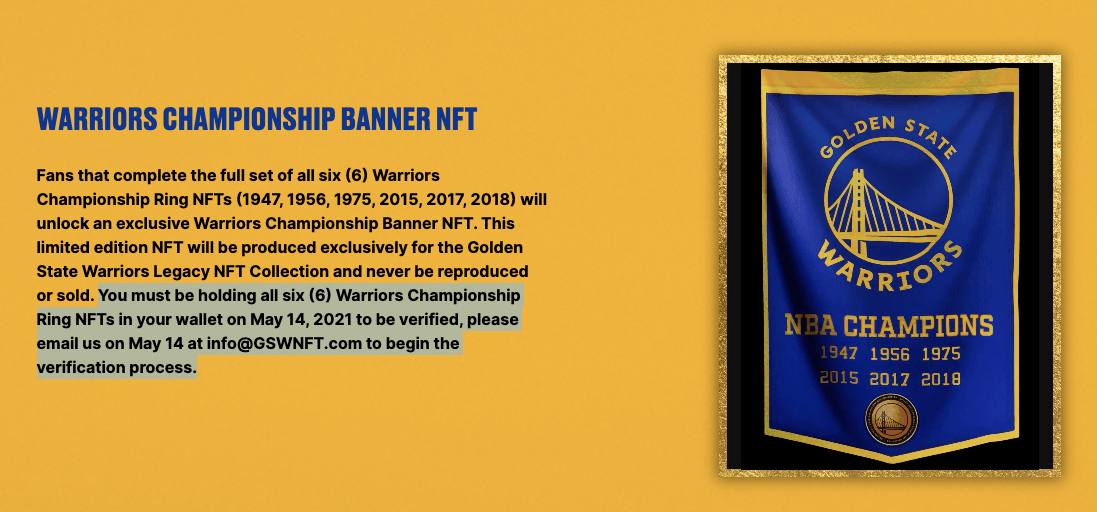

You can imagine that NFTs can function as a sort of key or checkpoint that unlocks other NFTs. This is how the Golden State Warriors gated their most exclusive NFT: the Championship Banner. Holders needed all 6 Championship Ring NFTs in their wallet to access this. We've seen other cool examples over the last year, like WhaleDAOs NFT museum gating access to a certain VIP room solely for Whale NFT holders.

Economic Alignment

Many of us are used to getting our favorite products, services, and content for free, usually monetized by ads. Web3 business models are 'better than free', allowing consumers to invest by consuming and potentially earning from being early. Not only is this empowering for users, it comes with additional benefits. First, users are incentivized to become evangelists of the project, spreading it to their friends and family to boost demand for access. Second, there is a strong first-mover advantage, which should incentivize users to join early and establish some FOMO.

Composability

It's also extremely composable meaning you could gate w multiple tokens and nfts at once easily; "need platinum access (own 10 WRITE, 100 ETH, 3 zNFTs or a crypto punk) to use this feature". Imagine if they let RAC holders RSVP because they think it's a cool community or collaborated on the party. They can do that despite RAC using Zora to mint and FWB minting on Roll. Let's see Eventbrite and Facebook pull that off. There is also a great advantage here in terms of interoperability and customer targeting. One of the only times people used crypto this whole week in Miami was the token-gated FWB party, where RSVPing required holding FWB. Most if not all of those people didn't buy tokens at this rsvp page for this party. They've had them and their ownership of tokens represents membership over time: no payment, no gas, no email/data trail beyond eth address.

Liquidity

In traditional SaaS, users would be locked into a product/service for a set amount of time. But with tokenized services, consumers can liquidate, or sell their tokens, when they're finished using the service. Additionally, they will be able to subscribe just for the amount of time that they'd like to, rather than commit forever.

Versatility

Tokens can serve multiple purposes. This is similar to how Amazon Prime gives subscribers access to faster delivery AND a suite of movies/shows ready for streaming. While Amazon Prime Music might be a failing product of its own, it increases demand and enhances utility that comes from being an Amazon Prime member.

Many argue that there are serious issues with basing a token economic model on gated access, as consumers will purchase the tokens whenever they wish to access, rather than hold the token. Additionally, they may find themselves having to change their token supply to respond to market forces (the price of token going up or the number of tokens needed to access going down). To mediate this, we propose a lockup NFT model that can achieve long-term alignment between consumers and service providers.

Token Emissions are the natural next step for SaaS because of the important consumer incentives, evangelism, and upside. Compared to existing models, it's a whole lot less paying. Imagine claiming a concert NFT once and now having access to an artist's Patreon forever, despite the concert being set up by completely different companies with no ties to Patreon.

Angel audiences

Imagine you're in a five-year-long fishing competition with one of the best fishermen alive. You start with nothing but a hook and a small wooden raft, while he already has a nice rowboat, a bucket of baitfish, a rod, and some cash. Buying new supplies requires cash, which can only be earned by selling fish. Catching more and bigger fish requires better supplies. Play this out five years and guess who has managed to get a huge motorboat and land the blue marlin?

This is the competition new creators enter every day on the internet.

Zero marginal cost of distribution means that a single creator can serve endless fans without incurring major operational costs that make them charge more for the service. I can get a tennis lesson from one of the best players on tour, attend a live concert from a grammy-winning artist, and learn how to filet a halibut from a Michelin starred chef --- all online, for next to nothing.

If the main challenge with building the creator middle class is helping creators establish initial traction, which systems would we need to put in place to make that possible? What existing models from other areas can we use for inspiration?

In startup land, angel investors fund projects at their very initial and riskiest steps. Although some do it to great profit, the term "angel" comes from the idea that the capital they provide is a godsend to entrepreneurs who would otherwise be too early to get investment from banks or have more established means. They are often former entrepreneurs themselves, interested in part just for the fun of it.

Creators also need investment at very early moments before they find true content <> audience fit, but even just extending the analogy it's clear that their angels will look different. If a startup's angels are successful CEOs, a creator's angels would be other successful creators.

Another fairly obvious but critically important difference between creators is that most creators have neither the desire nor capability to establish LLCs, issue shares, or otherwise build some way for people to share in the potential upside of their growth. A key reason for that is that most creators --- even successful ones --- won't ever be so big that it warrants the overhead of setting up traditional shareholder-type structures.

Tokenized subscription could create an angel audience of other creators, investing in something very early and very risky with the dream of a potential upside but also just for the fun of it. We see this already with so much of what's happening with Web3. There are pure speculators but that alone would be nowhere near enough to spin the wheel as fast as it is turning. Many people are making statements with their wallets about their values and the future they want to see, and the chances of a return just sweeten the deal.

Business Model

To better understand this model, let's build standard revenue projections that one would expect from traditional SaaS.

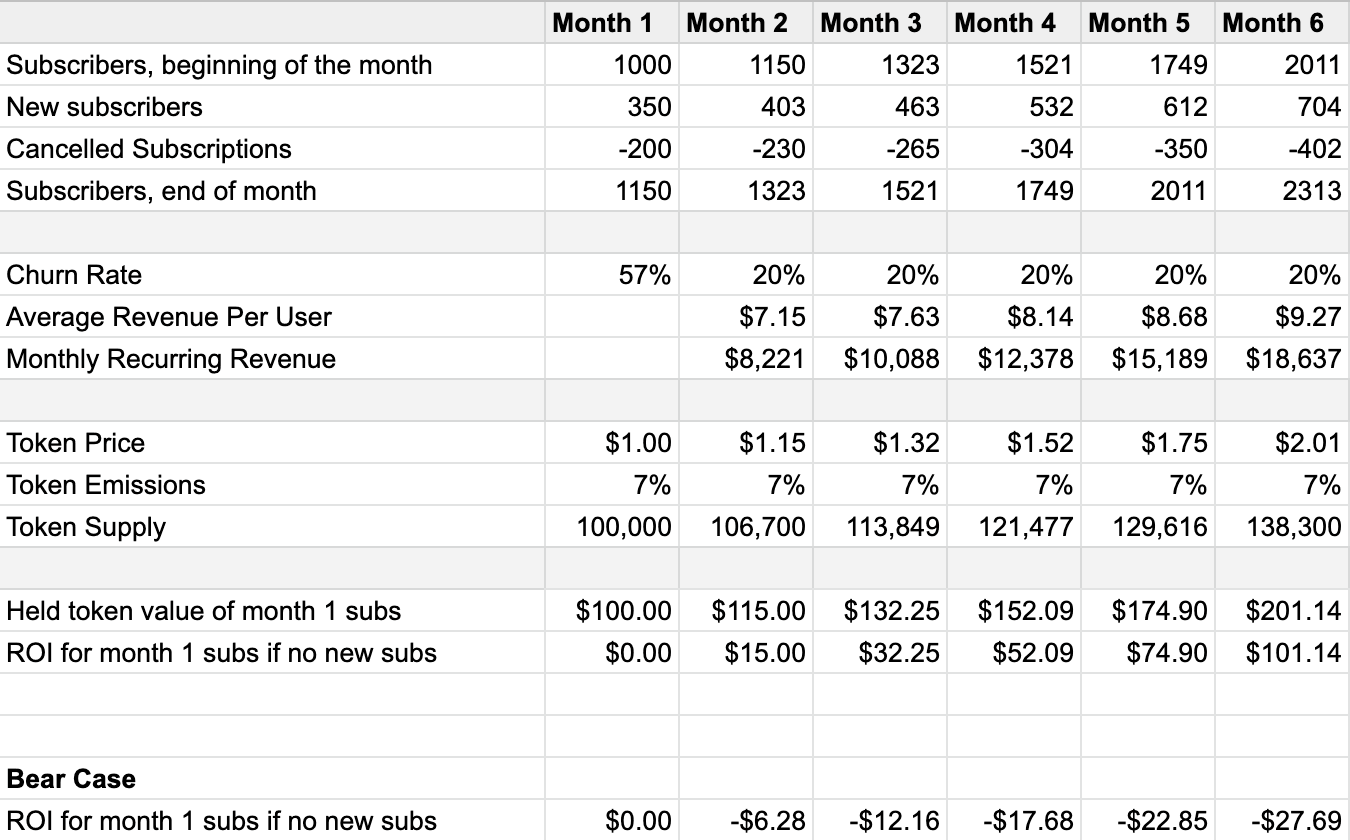

Let's say you're selling a new SaaS product (let's call it "Saasy" for fun) and expect ~1000 subscribers to be willing to pay $5 for the service in monthly subscription fees. But you need >$10k/month to survive. In the past, your only options in this situation would be to raise venture capital. But if your early supporters are 'true fans', you now have an alternative option. Instead of subscription fees, you tokenize access to that service, requiring subscribers to hold $100 in SAAS tokens to access. You then mint and sell 9% of new tokens a month.

Below is a graph outlining 6 months of this token-gated business' gross revenues. Several assumptions were made, such as a higher churn rate than usual (20%), because users can liquidate at any moment rather than wait until the end of the month, an 8% MoM growth in subscribers.

Instead of calculating Average Revenue Per User (ARPU) as subscriptions * product price, here we multiply emissions by token price. The Churn Rate in this model is essentially the liquidation rate: existing users who sold because they get no more utility from the product.

If the token price stays the same, the consumer can expect to pay/lose $27 in 6 months. But, if your early subscribers think there's at least a 20% chance you'll gain 1000 net new subscribers in 6 months, this increases their expected return, so they'll be willing to hold $100 worth of tokens, allowing you to earn $8 per user.

For simplicity's sake, we left out any speculating/trading, token buy-backs/burns, lock-ups/pools, or the various other tokenomics mechanisms that could be implemented here.

The Creator middle class

Right now in the creator space, the closest thing to this model is in the upfront advances that more and more big platforms are paying creators to join and produce content. Substack, Clubhouse, Snapchat, Facebook, YouTube, and others all pay cash advances to creators in the hopes that they then generate even more revenue for the platform. So far, it makes sense that those platforms have benefited disproportionately from creator content and have remarkably deep pockets as a result. They can spread the risk of failure across a huge number of creators and offer cash upfront that creators couldn't dream of otherwise. Especially for less established creators, that upfront cash is the only way they can dive in and build traction.

Web3 is pushing from several angles to make creators less dependent on platforms, and expanding the way creators can generate upfront financing would be a key way to do that. By all accounts, it seems that the primary revenue model for the next wave of creators is freemium, and tokenized subscriptions fit neatly into that frame.

No doubt there are many unanswered questions. The technology to enable this new model still has a way to go and, for it to be useful for most creators, it will have to become a whole lot less "crypto-y." Web3 is growing fast, but most creators and consumers just want to create and consume content without having to dive too far down the rabbit hole. Unless the crypto can be hidden behind the surface, it seems likely that more traditional non-token access models will need to live in parallel for creators to maximize their revenue.

The building blocks are all in place for angel audiences and tokenized subscriptions, and the potential implications are huge. It won't be for everyone or every creator, but even if incentivizing early financing could increase creator innovation by 1%, the compounding dividends overtime for all of us would be astronomical; a bigger creator middle class, less dependent on huge platforms, and more connected to the audience that can help them grow.

Web3 Freemium

Membership models are not and will not have to be binary -- free or gated, fees or tokens -- the answer is probably both or all. I think if there's a Slack free, Slack teams, Slack pro, and Slack partners and partners need tokens but get additional advantages/features/sales/etc. people will do that and bet that there will be a demand for that tier in the future.

Conclusion

Ultimately, tokenized software and services will enable new economics and incentives for creators and small businesses. This can be paired with free or traditional subscription fees to empower super users/fans without adding friction. This is good for customers since they can pay less and have a better experience. It's good for creators since they can sustain their businesses. It's also good for investors since they don't need to give up equity and can have a real stake in the success of that business.